Avoid the #1 Mistake Investors Make

The biggest mistake real estate investors make is shopping for funding too early. It may seem like a smart first step, but lenders rarely consider deals that aren’t under contract—because until a contract is signed, that property is still available to anyone.

Here’s the smarter approach:

Secure the deal first—then look for funding.

The Simple 4-Step Process to Get a Property Under Contract:

- Find & Review Properties

- Submit Offers

- Get an Offer Accepted

- Place Earnest Money in Escrow

Once completed, you’ll have a fully executed Purchase and Sale Agreement, meaning the property is under contract and you’re ready to shop for funding.

Ready to get a term sheet?

Fill out the form at the bottom of the page, and we’ll get back to you within 24 business hours.

5 Reasons Investors Use Private Money

- Speed

Private money is fast. While traditional loans can take 1–3 months, private funding can be secured in a few days to a few weeks, depending on how quickly you submit your documents. - Collateral-Based

Private lenders focus on the value of the property, not your credit score. If the deal is solid, the funding is likely. - Accessible Capital

Private money often comes from individuals looking for higher returns than they’d get from CDs, stocks, or IRAs—making it widely available for real estate investors. - Creative Solutions

Banks avoid properties needing repairs. Private lenders embrace them, making it easier to fund profitable fix-and-flip projects that traditional lenders reject. - Flexible Terms

With fewer restrictions, private lenders can structure creative financing solutions tailored to your project’s needs.

Confidence to Close Deals

Having a private lender like Solution Investors Inc. gives you the confidence to move fast. If your deal fits our guidelines and due diligence checks out, we’ll fund it—no games, no red tape.

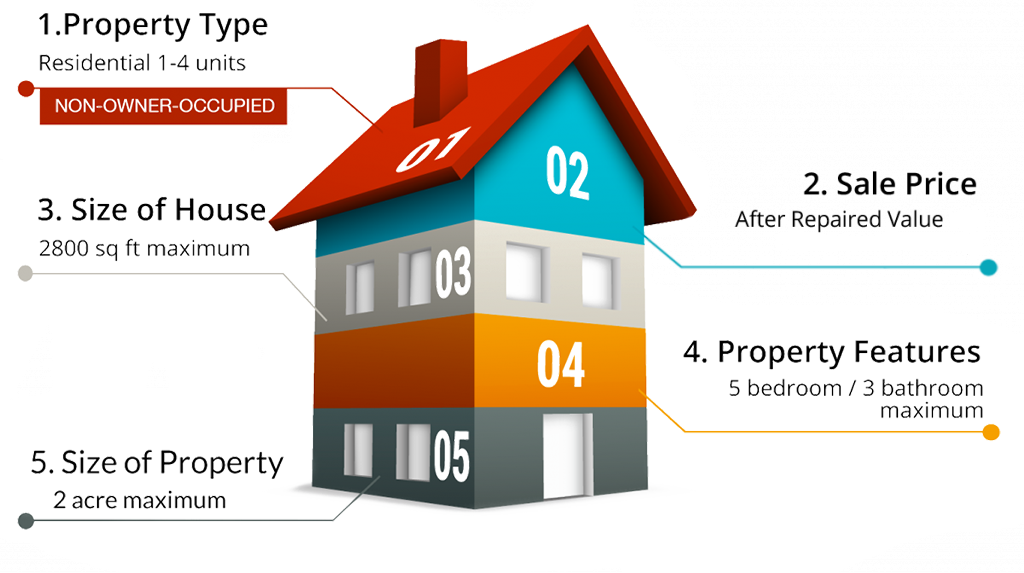

Our 5-Point Investment Criteria

To help you find the best fix-and-flip deals, we fund only properties that meet key success factors:

Price Within FHA Limits

Find the deal, do your homework, submit the application—we’ll take care of the rest.

The Bottom Line

At Solution Investors, we fund smart, market-ready deals that match real buyer demand.

We look for properties that are:

Properties above FHA loan caps tend to be more volatile and sensitive to market shifts. We focus on homes that fall within these limits, which are typically more stable and easier to resell.

Our goal is to fund deals that maximize your potential for profit while protecting your investment.

Why We Focus on 1–4 Unit Properties?

Properties with 1 to 4 units appeal to a broader market—including FHA buyers—making them easier to finance and sell. These homes are eligible for more flexible loan programs, increasing your chances of a quicker, more profitable exit.

Why Stay Within FHA Loan Limits?

Pricing your property at or below FHA loan limits attracts first-time homebuyers, one of the largest buyer segments in the market. This gives you a better chance of selling faster and with fewer financing issues.

Why Smaller Homes (5 Beds / 3 Baths or Less)?

Smaller homes are in higher demand, especially among Millennials entering the market and Boomers looking to downsize. As noted in The Wall Street Journal, buyers across generations now prefer smaller, more modern homes over large, ornate ones.

Why Less Than 2 Acres?

Large lots mean more maintenance and higher costs. Both Millennials and Boomers favor low-maintenance properties, making homes with less than 2 acres more attractive—and easier to sell.

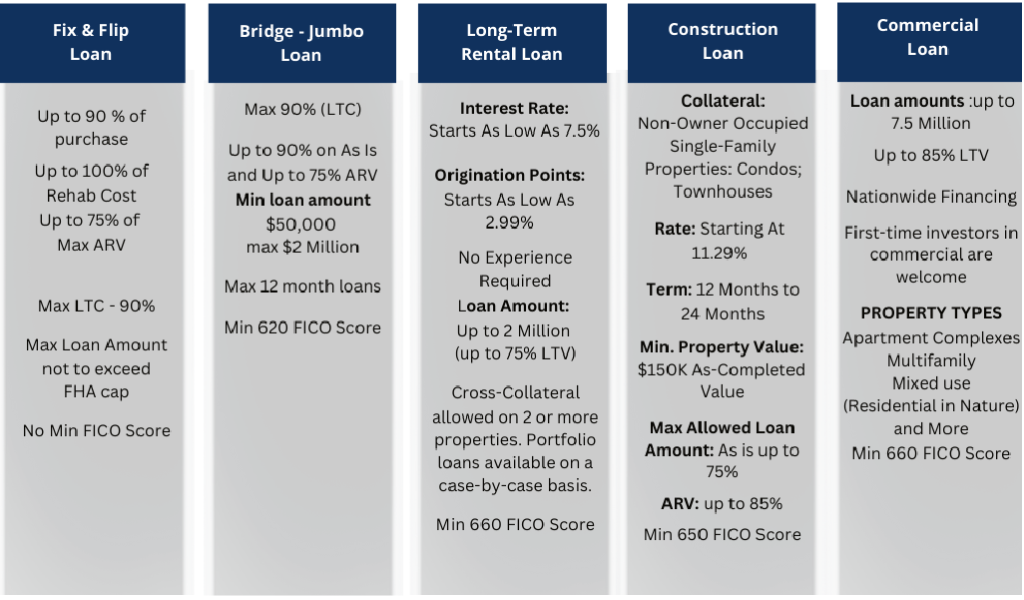

Types of Deals Solution Investors

Loan Terms

- Loan Amount

There’s no cap—just bring us your deal! We offer funding from $30,000 up to the FHA cap in your property’s county. Larger amounts may be available depending on the deal and loan type.

Call us today to discuss your specific project. - Rates & Fees

Rates start at 7.5% annualized interest

Origination fee: 0–5%

No prepayment penalties

Note: Rates are influenced by credit score, but credit score does not determine approval. - Loan Terms

Fix & Flip: 6 months to 2 years

Buy & Hold / Refinance: Up to 30 years

Only one loan is approved per applicant until a successful track record is established.

Ready to Get Started?

Fill out the form below and let us know how we can help. A team member will reach out within 24 business hours.